How to Choose a Dash Cam for Your Fleet

Making the case for implementing connected dash cams in your businessWhat is the Best Dash Cam in 2025?

Fleet operations are changing, and dash cams are becoming a must-have safety investment across fleets.

Choosing the right dash cam is a decision most fleet owners, operators, and safety leaders are already considering or will in the near future. The right dash cam can have a dramatic impact on a fleet's profit and safety.

Access to video footage tells the true story of what's happening on the road, making dash cams a tool that directly reduces claims costs and improves driver safety. We see many of our customers reducing incident occurrence by 30 - 60% and claims costs by around 50%. Some fleets have reduced claims costs and insurance spend by as much as 84% after implementing SureCam. The benefits are obvious to most fleets, but choosing the right solution can be challenging.

Tips For Choosing the Right Dash Cam

Choosing a dash cam can be overwhelming, with so many options available on the market. Here are some factors you can consider to help you make an informed decision for your fleetVideo quality

Look for a dash cam that records in high-definition (HD) or even ultra-high-definition (UHD) resolution. The higher the resolution, the clearer the video will be, which can be helpful in case of an accident or incident.Night vision

If your drivers frequently travel at night, consider a dash cam with night vision capabilities. This will ensure that the camera can capture clear footage even in low-light conditions.Size and design

Consider the size and design of the dash cam. A compact and discreet design may be preferable as it will not obstruct your driver’s view while driving.Storage capacity

Look for a dash cam with ample storage capacity. Some models come with a microSD card, while others have built-in storage or are cloud-connected.GPS tracking

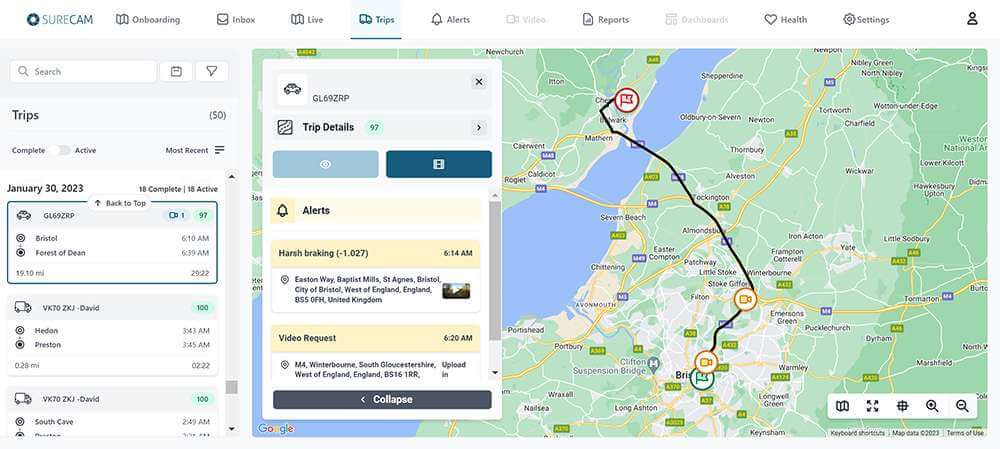

Some dash cams come with built-in GPS tracking so you can see the location of your fleet at all times.Price

Look for a dash cam that offers good value for the features it provides and fits your budget. Don’t sacrifice the safety of your fleet for a cheaper price tag.Questions to Ask When Searching for Dash Cams

When fleets are considering SureCam and attempting to select the best dash cam for their operations, it’s vital to consider three main questions:

- What am I hoping to achieve by installing dash cams?

- What are the dash cam features I must have and will actually use?

- How will we manage our cameras and safety in the long term?

What am I hoping to achieve by installing dash cams?

Fleets usually have one or two main criteria behind their decision to implement premium dash cams. For example, some fleets recently paid out a large claim that wasn't their fault, or another fleet may be dealing with a company-wide safety issue. It's important to start by understanding what outcomes are influencing the decision to install cameras.

The main reasons I see our customers install cameras include:

- Reducing claims costs with video evidence

- Identifying risky driving across the fleet

- Gaining greater visibility into field and fleet operations

- Utilizing video for an efficient coaching tool

After a fleet has identified why they are installing cameras, and what they are hoping to gain, they are in a better position to evaluate the features and price that fits best with their needs.

What are the dash cam features I must have and will actually use?

There is a diverse range of features available in the market, and it's important for a fleet to identify the features they actually need in a camera system to avoid paying for features that will rarely be used. Most dash cams record footage with high video resolution but may not offer much more.

Fleets that use SureCam typically prioritize the following features:

- Instant access to harsh driving and accident videos

- Remote access to live dash cam feeds

- Full suite of GPS tracking functionality

- An easy-to-use web platform

- Reliable hardware

- Customization

It's just as important to identify features that sound exciting but will rarely or ever be used. For example, if you have a fully staffed coaching program, selecting a fleet dash cam with a robust coaching workflow may serve your needs best. However, if you only plan to do coaching as needed with your workers, you can save money by selecting a straightforward fleet video platform rather than a video-enabled coaching tool.

How will we manage our cameras and safety in the long term?

Lastly, when searching for the best dash cams, I encourage fleets to think about how they will manage cameras and safety beyond the initial rollout.

I typically find myself discussing topics such as:

- Who in the organization needs access to the dash cam data, and how will they use it?

- How will the technology be used to support coaching and driver training?

- How will communication with drivers be handled?

- How will dash cam video be used to maximize reductions in claims costs?

- What policies need to be updated to accommodate the use of dash cams?

Installing cameras is only the first step, and maximizing ROI includes a thoughtful and long-term commitment that SureCam often helps our fleets design. We're more than just a great dash cam company.

Book a demo today!

SureCam offers GPS vehicle tracking, live video, and real-time alerts for efficient fleet management. Get a Demo