Do Fleet Dashcams Reduce Insurance?

Can You Reduce Insurance With Fleet DashCams?

Dashcams have become increasingly popular safety devices among commercial fleets. In fact, over half a million dashcams were sold in the UK alone in 2018.

But do dashcams actually lower your insurance premiums?

One area of insurance in which cameras can have an instant impact is in settling disputed claims or when a fleet vehicle is the victim of a crash-for-cash scam. Video evidence from dashcams serves as undeniable ‘proof of incident’ showing exactly what happened, when and where.

If you’re involved in a disputed claim, providing your insurer with dashcam footage of the incident can speed up the claims handling process, prove you weren’t at fault and reduce your claims costs.

Using in-vehicle cameras also encourages more responsible driving. Safer drivers tend to have fewer driving incidents and fewer claims.

Using reliable dashcam footage to reduce insurance claims

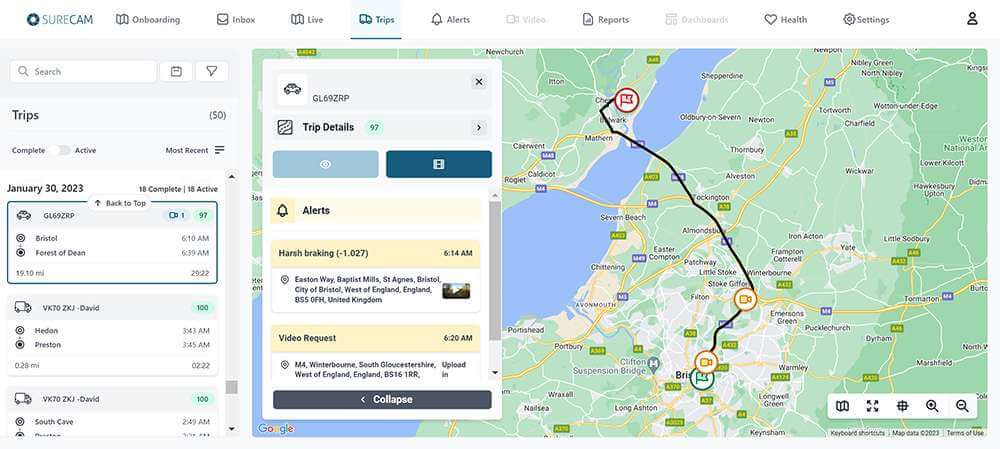

In the event of an insurance claim by a third party, your insurance company will consider dashcam footage of the incident as part of their investigation. But to be of any use as video evidence, your dashcam images will need to be reliable and clear.

HD quality footage allows you to capture details like license plate numbers helping your insurer and relevant authorities to see the details of what happened.

Failing to capture third-party information can inflate overall incident costs by 956%. (Source: Zurich Global Corporate UK)

Connected cameras have a particular benefit over SD card-based cameras when it comes to insurance. They give instant access to video files within seconds and without any user intervention. This means you can quickly notify your insurer about an incident.

Insurers are keen to secure First Notification of Loss (FNOL) and have access to any video evidence that helps them to confirm liability, reduce claims processing times and minimise costs.

The average cost of a claim when reported within 2 hours is £1,250 compared with over £5,000 when there is a delay. (Source: Zurich Global Corporate UK)

Insurance discount with dash cams

Although simply installing fleet cameras won’t guarantee an upfront insurance discount. Some fleets have used evidence from dashcams to successfully reduce insurance premiums.

Evezy, the UK’s largest electric vehicle fleet, initially faced challenges when trying to find a competitive insurance policy. When the business started up, electric vehicles were fairly new to the market and traditional insurers viewed their business model as high risk which would attract a high premium.

Evezy used dashcams and telematics data to gain insight on how their vehicles were being operated and they put in place risk management and safety processes. They shared this data with insurers demonstrating that their business was low risk and successfully reduced their insurance premiums.

Fleet insurers consider a number of factors when setting premiums. Vehicle technology like dashcams provides insurers a wealth of driving data that helps to build a picture of risk. Insurers then set premiums based on the level of perceived risk – lower risk fleets attract lower premiums.

Best dash cams for car insurance

If you’re installing vehicle cameras in your fleet solely to reduce insurance premiums, it’s important that they have these key features:

- HD Quality: The camera needs to record high-quality footage to be used as video evidence by your insurer or police. They need to clearly see important details like road signs and number plates. Footage from a basic non-HD camera system will be low resolution and therefore not accepted by insurers.

- Network connectivity: Connected cameras are ideal for insurance purposes as they use a mobile data network to transmit footage within seconds of an incident occurring. Quick and accurate reporting can help to reduce insurance premiums. SD card-based cameras may work for fleets that return to a depot at the end of the working day where the data can be downloaded frequently, but if this is not the case then the footage runs the risk of being overwritten and vital evidence being missed.

- Be professionally mounted: Some insurers recommend that your dashcams are professionally fitted using the right mounts and positioned to get the best viewing angle. It’s best to check with your insurer what their specific requirements are.

Do I need an insurance approved dash cams/insurance recommended dashcams?

No, you don’t.

Insurance companies will accept footage if it is clear enough to identify who is at fault during an incident. Most connected dashcams are insurance approved as they offer HD quality footage and allow the insurers to confirm liability and settle claims quickly.

Self-insured fleets and dashcams

As a company’s fleet gets larger it becomes more cost-effective to self-insure.

Self-insurance is a risk management tool, in which a calculated amount of money is set aside by the business to compensate for potential future loss.

If you’re a self-insured fleet, you will know the importance of claims handling and risk controls. Adopting vehicle technology like dashcams helps to minimise the number of collisions and improve your overall claims experience. Fleets receive the financial benefit immediately rather than waiting for their insurer to reflect the improvement over time with lower premiums.

Need help reviewing connected dash cameras? Our team can help you find the information you need.

Book a demo today!

SureCam offers GPS vehicle tracking, live video, and real-time alerts for efficient fleet management. Get a Demo